Mastering Stock Trading and Investing: Embracing Risk Management

Mastering Stock Trading and Investing: Embracing Risk Management

Trading and investing in stocks offer incredible opportunities for financial growth, but they also come with inherent risks. To truly excel as a trader or investor, you need to recognize the essential role of risk management. It goes beyond just pinpointing the perfect entry point; it’s about diligently protecting your capital and making well-informed decisions. In this post, we’ll explore the nuances of risk management and offer insights to guide you on your trading and investing journey.

The Essence of Risk Management in Trading and Investing:

Risk management is the cornerstone of any successful trading or investing strategy. It’s a blend of techniques and strategies designed to shield your capital and pave the way for long-term financial prosperity. While the prospect of rapid gains can be enticing, it’s essential to keep risk management at the forefront.

Assessing Your Risk Tolerance:

Knowing your risk tolerance is a fundamental step in the trading and investing process. This personal metric takes into account your financial situation, your objectives, and your comfort level with potential losses. Appreciating this facet of your journey is paramount.

Prioritizing Risk Over Entry Points:

Successful traders and investors often shift their attention from merely seeking the perfect entry point to efficiently managing risk. This transition involves adopting risk-mitigation tactics such as setting stop-loss orders, diversifying portfolios, and steering clear of excessive leverage. By curtailing potential losses, you lay a resilient foundation for your financial endeavors.

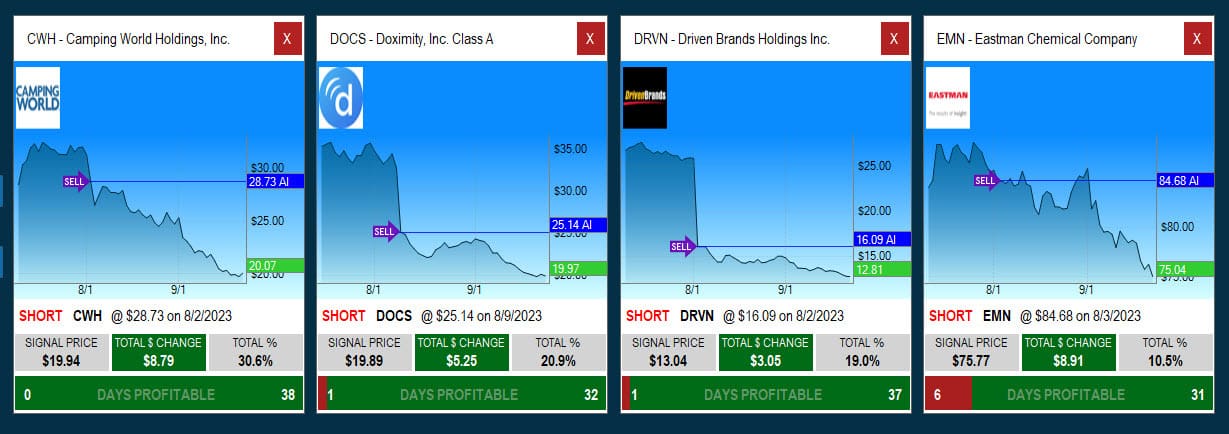

Harnessing the Power of Trade Ideas:

Trade Ideas, an advanced trading and investing platform, arms you with tools to bolster your risk management acumen. It provides a sandbox for users to test trading and investing strategies, much like a golfer’s practice range. This simulated platform is indispensable for honing skills in a risk-free environment.

Charting Your Path to Trading and Investing Success:

Mastering the art of trading and investing requires more than just chasing market opportunities. It demands a comprehensive understanding of risk management, a commitment to capital preservation, and the use of valuable tools like Trade Ideas. By knowing your risk tolerance, zeroing in on risk management, and continual learning, you’re positioning yourself for an enhanced trading and investing experience.

As you embark on your trading and investing journey, remember that each trader and investor has a unique path. There’s no one-size-fits-all approach to risk management, so take the time to assess your risk tolerance, develop a robust risk management strategy, and practice in a simulated trading environment. With the right foundation in place, you’ll be better prepared to navigate the complexities of trading and investing successfully.