Estimated Quarterly EPS Growth

Table of Contents

- Understanding the Estimated Quarterly EPS Growth Filter

- Estimated Quarterly EPS Growth Filter Settings

- Using the Estimated Quarterly EPS Growth Filter

- FAQs

Understanding the Estimated Quarterly EPS Growth Filter

Estimated Quarterly EPS Growth is a financial metric used to estimate the quarterly growth rate of a company's earnings per share (EPS). It compares the current quarterly data to the previous quarterly data. The ratio provides insight into the company's earnings growth trajectory on a quarterly basis, helping investors assess its performance and potential changes in earnings momentum.

Calculation: The formula for Estimated Quarterly EPS Growth is: (current EPS estimate - last quarter actual EPS) / current EPS estimate.

Interpretation: A positive Estimated Quarterly EPS Growth indicates that the current EPS estimate is higher than the EPS from the previous quarter. This suggests potential earnings growth compared to the previous period. A negative value indicates that the current EPS estimate is lower than the EPS from the previous quarter, suggesting a decline in earnings compared to the previous period. The magnitude of the ratio reflects the percentage change in EPS from the previous quarter relative to the current EPS estimate.

Estimated Quarterly EPS Growth Filter Settings

Configuring the "Estimated Quarterly EPS Growth" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

- Set the minimum value to 15 to see only stocks where the estimated quarterly earnings are up at least 15% from last quarter.

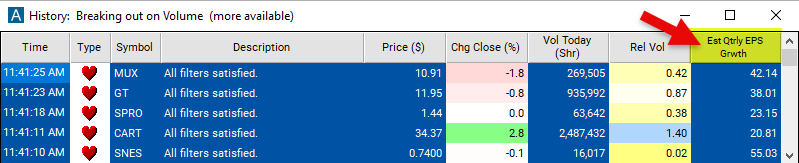

Using the Estimated Quarterly EPS Growth Filter

The "Estimated Quarterly EPS Growth" filter can be used in various trading strategies, including:

Momentum Trading: Identify stocks with high Estimated Quarterly EPS Growth rates, indicating strong earnings momentum. Take long positions in these stocks to capitalize on potential price appreciation resulting from positive earnings surprises.

Contrarian Strategy: Identify stocks with low Estimated Quarterly EPS Growth rates relative to market expectations. Evaluate whether the market may be underestimating their growth potential, leading to potential buying opportunities. Take contrarian positions in stocks with favorable long-term prospects but temporarily depressed growth expectations.

Long-term Investing: Consider Estimated Quarterly EPS Growth as part of a long-term investment strategy. Invest in stocks with consistent and sustainable growth rates, aiming to capitalize on their long-term earnings growth prospects. Focus on companies with strong fundamentals and competitive advantages that support sustainable growth.

FAQs

What is Estimated Quarterly EPS Growth, and why is it important?

- Estimated Quarterly EPS Growth represents the expected quarterly growth rate of a company's earnings per share (EPS) and is used to assess changes in earnings momentum. It is important because it provides insight into a company's short-term earnings performance and potential changes in earnings trajectory.

How is Estimated Quarterly EPS Growth calculated?

- EQEG is calculated by comparing the current EPS estimate for a specific quarter to the actual EPS from the previous quarter. The formula for EQEG is: (Current EPS estimate - Last quarter actual EPS) / Current EPS estimate.

What does a positive/negative Estimated Quarterly EPS Growth indicate?

- A positive EQEG suggests that the current EPS estimate is higher than the EPS from the previous quarter, indicating potential earnings growth. A negative EQEG indicates that the current EPS estimate is lower than the EPS from the previous quarter, suggesting a decline in earnings compared to the previous period.

Filter Info for Estimated Quarterly EPS Growth [EstQEPSG]

- description = Estimated Quarterly EPS Growth

- keywords = Fundamentals Changes Daily

- units = Ratio

- format = 2

- toplistable = 1

- parent_code =