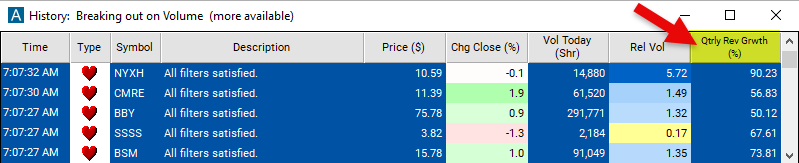

Quarterly Revenue Growth

Table of Contents

- Understanding the Quarterly Revenue Growth Filter

- Quarterly Revenue Growth Filter Settings

- Using the Quarterly Revenue Growth Filter

- FAQs

Understanding the Quarterly Revenue Growth Filter

Quarterly Revenue Growth refers to the percentage increase or decrease in a company's current revenue to that of 12 months ago. It is a key metric used by investors and analysts to assess a company's financial performance and growth trajectory over short-term periods.

The result is expressed as a percentage, representing the increase or decrease in revenue relative to the previous quarter. A positive percentage indicates revenue growth, while a negative percentage indicates revenue decline.

Quarterly Revenue Growth provides insights into a company's sales momentum and revenue trends over shorter time frames, allowing investors to assess the company's ability to generate increasing or decreasing sales volumes.

Here's how it is used in stock trading:

Performance Evaluation: Traders use Quarterly Revenue Growth to evaluate a company's recent financial performance. Positive revenue growth may indicate strong demand for the company's products or services, effective sales strategies, and overall business expansion. Conversely, negative revenue growth may raise concerns about declining sales, market saturation, or operational challenges.

Comparative Analysis: Quarterly Revenue Growth allows traders to compare a company's revenue performance with its peers and industry averages. By analyzing revenue growth rates across companies within the same sector or industry, traders can identify relative winners and losers and make investment decisions accordingly.

Quarterly Revenue Growth Filter Settings

Configuring the "Quarterly Revenue Growth" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

-

Set the minimum value to 50 to see only stocks with a current revenue 50% higher than the previous quarter.

-

Set the maximum value to 0 to see ony stocks with a current revenue that is less than it was the previous quarter.

Using the Quarterly Revenue Growth Filter

The "Quarterly Revenue Growth" filter can be used in various trading strategies, including:

Momentum Trading: Momentum trading strategies involve buying stocks of companies with positive Quarterly Revenue Growth and selling stocks of companies with negative or declining revenue growth. Traders aim to ride the momentum of revenue growth trends and capitalize on short-term price movements driven by changing revenue expectations.

Earnings Surprises: Traders may focus on stocks with positive earnings surprises resulting from better-than-expected Quarterly Revenue Growth. By identifying companies that exceed revenue expectations in their earnings reports, traders can initiate long positions to capture potential price appreciation fueled by positive revenue surprises.

Sector Rotation: Sector rotation strategies involve rotating investments among different sectors based on Quarterly Revenue Growth trends and sector performance. Traders may allocate capital to sectors or industries with strong revenue growth prospects while reducing exposure to sectors experiencing revenue declines or slower growth. Sector rotation strategies aim to capitalize on changing revenue dynamics across industries and sectors.

FAQs

What is Quarterly Revenue Growth, and why is it important?

- Quarterly Revenue Growth refers to the percentage increase or decrease in a company's revenue from one fiscal quarter to the next. It is important because it provides insights into a company's sales momentum, revenue trends, and growth trajectory over short-term periods. Investors and analysts use Quarterly Revenue Growth to assess a company's financial performance and investment potential.

What factors can influence Quarterly Revenue Growth?

- Several factors can impact a company's Quarterly Revenue Growth, including changes in consumer demand, pricing dynamics, competition, economic conditions, industry trends, product innovation, marketing strategies, and regulatory environment. Revenue growth can also be influenced by company-specific factors such as new product launches, acquisitions, and market expansion efforts.

How does Quarterly Revenue Growth affect stock prices?

- Quarterly Revenue Growth is a key driver of stock prices, as investors closely monitor companies' revenue performance to gauge their financial health and growth prospects. Positive Quarterly Revenue Growth can lead to stock price appreciation, as it signals strong sales momentum and revenue expansion. Conversely, negative or declining Quarterly Revenue Growth may result in stock price declines, as it raises concerns about the company's growth prospects and market competitiveness.

Filter Info for Quarterly Revenue Growth [QRevG]

- description = Quarterly Revenue Growth

- keywords = Fundamentals Changes Daily

- units = %

- format = 2

- toplistable = 1

- parent_code =