Float

Table of Contents

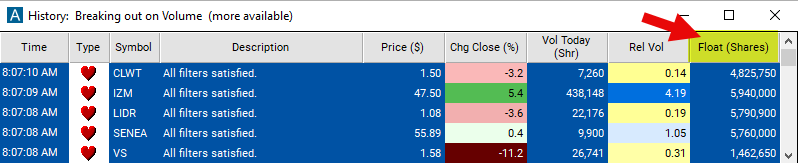

Understanding the Float Filter

In stock trading, the "float" refers to the number of shares available for trading in the market. The float filter focuses on identifying stocks with specific characteristics related to their float size, which can provide insights into their liquidity, volatility, and potential trading opportunities.

Here's how float works:

Definition of Float: The float represents the total number of shares of a company's stock that are available for trading on the open market. It excludes shares held by insiders, such as company executives and major shareholders, as well as shares held by institutional investors or restricted from public trading.

Calculation of Float: The float is calculated by subtracting the restricted shares, insider holdings, and other non-tradable shares from the total outstanding shares of a company. The resulting number represents the float or the shares available for trading among the general public.

Filtering Process: The float filter involves screening stocks based on their float size. Traders may set specific criteria to identify stocks with float characteristics that align with their trading strategies. For example, they may filter for stocks with a small float (low float stocks) or those with a large float (high float stocks).

Interpretation of Float: The size of a stock's float can have significant implications for trading dynamics and price movements. Stocks with a small float tend to be more volatile and have limited liquidity, making them prone to sharp price swings. Conversely, stocks with a large float often have greater liquidity and stability but may exhibit slower price movements.

Float Filter Settings

Configuring the "Float" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

-

Adjust the minimum value to 1,000,000,000 to see only stocks with a more substantial float size.

-

Adjust the maximum value to 10,000,000 to see only stocks with a float of 10,000,000 or less.

Using the Float Filter

The "Float" filter can be used in various trading strategies, including:

Momentum Trading:

- High Float Stocks: Momentum traders may target stocks with a high float for their relatively stable price movements and liquidity. They may look for stocks with strong upward or downward momentum and initiate trades in the direction of the trend, aiming to capitalize on short-to-medium-term price swings.

- Low Float Stocks: Momentum traders may also target stocks with a low float for their potential to experience rapid and exaggerated price movements. These stocks can exhibit strong momentum due to supply and demand imbalances, presenting opportunities for quick profits through short-term trades.

Range Trading:

- High Float Stocks: Traders may employ range trading strategies on stocks with a high float that tend to trade within well-defined price ranges. They may buy near support levels and sell near resistance levels, taking advantage of the stock's stability and predictable price movements.

- Low Float Stocks: Range trading may be more challenging with low float stocks due to their heightened volatility. However, traders can still look for opportunities to trade within established price ranges, using technical indicators and market sentiment analysis to identify potential entry and exit points.

Breakout Trading:

- High Float Stocks: Breakout traders may seek opportunities in high float stocks that exhibit significant price movements beyond key technical levels or chart patterns. They may wait for the stock to break out of consolidation phases or trade above resistance levels, aiming to ride the momentum generated by the breakout.

- Low Float Stocks: Breakout trading can be particularly lucrative with low float stocks, as they are prone to sharp and rapid price movements. Traders may look for breakout opportunities following periods of consolidation or on the back of positive news catalysts, entering trades with tight stop-loss orders to manage risk.

FAQs

How is the float calculated?

- The float is calculated by subtracting restricted shares, insider holdings, and other non-tradable shares from the total outstanding shares of a company.

What is considered a high float or a low float?

- A high float generally refers to a large number of shares available for trading, contributing to greater liquidity and stability in the stock's price movements. Conversely, a low float indicates a relatively small number of shares available for trading, which can lead to higher volatility and limited liquidity. The specific threshold for what constitutes high or low float can vary depending on market conditions, industry norms, and individual stock characteristics.

How does float size affect trading dynamics and investment strategies?

- The size of a stock's float can influence trading dynamics, volatility, and liquidity. Stocks with high float are typically more stable and liquid, making them suitable for longer-term investing or swing trading strategies. In contrast, stocks with low float may experience higher volatility and limited liquidity, presenting opportunities for short-term trading or momentum plays.

How should I incorporate float data into my trading strategy?

- Traders can use float data as part of their trading strategy to identify opportunities and manage risk. For example, they may target high float stocks for longer-term investments or swing trading strategies, while focusing on low float stocks for short-term momentum plays or volatility trades. It's essential to consider float data alongside other factors such as fundamental analysis, technical indicators, and market sentiment when making trading decisions.

Filter Info for Float [Float]

- description = Float

- keywords = Fundamentals Changes Daily

- units = Shares

- format = 0

- toplistable = 1

- parent_code =