Short Float

Table of Contents

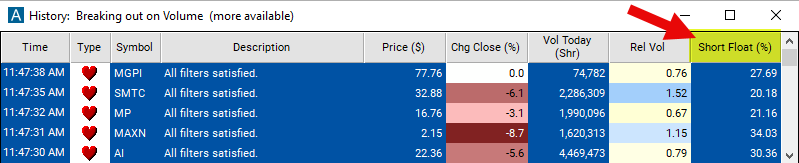

Understanding the Short Float Filter

The "short float" filter in stock trading is a tool used by investors and traders to analyze the level of short interest in a particular stock. Short interest refers to the total number of shares of a stock that have been sold short by investors, indicating their belief that the stock's price will decline. The short float filter specifically focuses on the short float, which is the percentage of a stock's total tradable shares that have been sold short.

Here's how the short float filter works:

Short Float Calculation: The short float is calculated by dividing the total number of shares sold short by the stock's total tradable shares (float) and expressing the result as a percentage. For example, if a stock has 1 million shares sold short out of a total float of 10 million shares, the short float would be 10%.

Filtering Process: Investors and traders use the short float filter to screen stocks based on their short float percentages. Stocks with higher short floats are considered to have higher levels of short interest, indicating greater bearish sentiment among investors.

Interpretation: A high short float percentage suggests that a significant portion of the stock's float has been sold short, potentially indicating widespread pessimism about the stock's future prospects. Conversely, a low short float percentage suggests lower levels of short interest and may indicate more bullish sentiment among investors.

Short Float Filter Settings

Configuring the "Short Float" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

-

Adjust the minimum value to 20 to see only stocks with a high short float percentage (20% or more).

-

Adjust the maximum value to 10 to see only stocks with a low short float percentage (10% or less).

Using the Short Float Filter

The "Short Float" filter can be used in various trading strategies, including:

Contrarian Strategy:

- High Short Float: When a stock has a high short float (e.g., above 20%), it may indicate widespread bearish sentiment among investors. A contrarian trader might consider taking a long position, anticipating a potential short squeeze if positive news or developments cause short sellers to cover their positions rapidly, driving the stock's price higher.

- Low Short Float: Conversely, when a stock has a low short float (e.g., below 10%), indicating bullish sentiment or lack of pessimism among investors, a contrarian trader might consider taking a short position if they believe the stock is overvalued or vulnerable to a downward correction.

Momentum Strategy:

- High Short Float: Momentum traders may seek to capitalize on the upward momentum of a stock with a high short float by buying when the stock price is rising. The potential for a short squeeze can amplify upward momentum, leading to rapid price appreciation.

- Low Short Float: Momentum traders may also target stocks with low short floats, as they may exhibit strong upward momentum with fewer short sellers to counteract price movements. These stocks may attract buying interest from investors seeking growth opportunities.

Volatility Strategy:

- High Short Float: Stocks with high short floats tend to experience increased volatility, especially during periods of significant news or events. Traders can use options strategies such as straddles or strangles to capitalize on anticipated price swings resulting from short squeeze potential or other market catalysts.

- Low Short Float: While stocks with low short floats may exhibit less volatility overall, they can still experience significant price movements in response to news or events. Traders can employ options strategies to profit from anticipated volatility spikes in these stocks.

FAQs

What does the short float percentage represent?

- The short float percentage represents the proportion of a stock's total tradable shares that have been sold short by investors. It indicates the level of bearish sentiment or skepticism about the stock's future performance.

What does a high short float percentage suggest?

- A high short float percentage suggests that a substantial portion of the stock's float has been sold short. This level of short interest often indicates strong bearish sentiment among investors and may lead to heightened volatility, increased risk of a short squeeze, and potential downside pressure on the stock's price.

What does a low short float percentage suggest?

- A low short float percentage suggests that only a small portion of the stock's float has been sold short. This may indicate relatively bullish sentiment among investors, as there are fewer traders betting against the stock.

Does a high short float percentage always indicate a bearish outlook for the stock?

- While a high short float percentage often indicates bearish sentiment among investors, it doesn't necessarily guarantee a negative outlook for the stock. Traders should consider other factors such as market trends, company fundamentals, and upcoming catalysts when interpreting short float data.

Filter Info for Short Float [SFloat]

- description = Short Float

- keywords = Fundamentals Changes Daily

- units = %

- format = 2

- toplistable = 1

- parent_code =