2 Minute Range

Table of Contents

- Understanding the 2 Minute Range in Dollar Filter

- 2 Minute Range in Dollar Filter Settings

- Using the 2 Minute Dollar Range in Trading

- FAQs about 2 Minute Range in Dollars

Understanding the 2 Minute Range in Dollar Filter

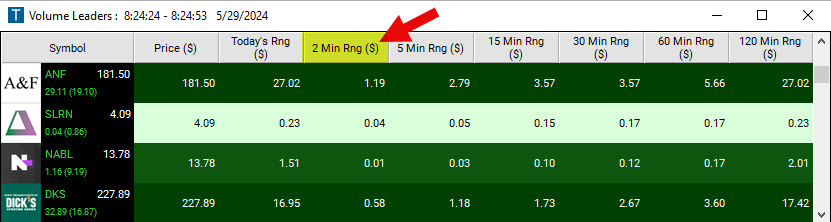

The 2-Minute Range in Dollar filter is a tool for active traders who need real-time, precise insights into the minute-by-minute volatility of a stock's price. It is especially useful for traders who participate in high-frequency trading or scalping strategies.

This filter calculates the difference between the highest and lowest prices a stock has traded within the last 2-minute time period.

As an example, if a stock hits a peak of $10.00 and a low of $9.90 within a specific 2-minute interval, the 2 Minute Range in Dollar Filter would return $0.10.

This filter is sensitive to all price movements, so a single price swing, regardless of how significant, can greatly impact the range.

Operating to the second, the 2-Minute Range Filter constantly updates as time ticks forward. This means at exactly 10:30:00, the filter will analyze the trades from 10:28:00 to 10:30:00. And at 10:30:01, it will consider trades from 10:28:01 onwards, thus always maintaining a precise 2-minute window.

This filter works before, after, and during normal market hours. As long as there's at least one trade within the 2-minute timeframe, the filter remains operative.

With the 2-Minute Range ($) Filter, an active trader can keep a real-time pulse on price fluctuations, gauge short-term volatility, and spot potential trading opportunities swiftly and accurately.

2 Minute Range in Dollar Filter Settings

Activating the 2 Minute Range ($) Filter is straightforward. You'll find its settings under the Window Specific Filters Tab in your Alert and Top List Configuration Window.

You can set a minimum and/or maximum value, and stocks that don't fit within your parameters are automatically excluded from your scan results.

-

To find stocks with a 2-Minute Range of at least 50 cents, add the 2 Minute Range ($) Filter to your scan and enter 0.5 in the minimum field in the Windows Specific Filters Tab.

-

To find stocks with a 2-Minute Range of no more than $2, add the 2 Minute Range ($) Filter to your scan and enter 2 in the maximum field in the Windows Specific Filters Tab.

-

To find stocks with a 2-Minute Range between 30 cents and $3, add the 2 Minute Range ($) Filter to your scan and enter 0.3 in the minimum field and 3 in the maximum field in the Windows Specific Filters Tab.

Using the 2 Minute Dollar Range in Trading

The 2-Minute Range in Dollar Filter is an excellent tool that can be used in numerous ways depending on a trader's individual strategy. Here are a few ways a trader can integrate this filter into their strategy:

- Scalping: Traders who employ scalping strategies often look for stocks with a significant price range within a very short timeframe. The 2-Minute Range in Dollar Filter can be used to pinpoint such stocks, providing opportunities for quick, profitable trades.

- High-frequency Trading: High-frequency traders can use this filter to keep track of immediate price fluctuations in real-time. By setting minimum and maximum values, traders can immediately identify stocks experiencing a specified level of volatility, offering potential trading opportunities.

- Volatility Trading: For traders focusing on volatility, this filter can be valuable. By observing the 2-Minute Range, they can assess the short-term volatility of a stock and make informed decisions based on these quick, precise insights.

- Pre/Post Market Trading: The filter's capability to operate beyond standard market hours makes it beneficial for traders who capitalize on the pre-market and post-market movements. They can track price movements in these timeframes and strategize accordingly.

FAQs about 2 Minute Range in Dollars

Can this filter be used for stocks across all price ranges?

Technically, yes. However, the significance of the 2-minute range may vary with the price of the stock. For example, a $0.10 range might be highly significant for a $2 stock but less so for a $200 stock. Therefore, you might want to adjust the filter parameters or the way you interpret the results based on the general price range of the stocks you're interested in. Alternatively, use our 2-Minute Range in % Filter to gain insights.

Is the 2 Minute Range in Dollar filter useful for longer-term trades?

The 2 Minute Range in Dollar filter is primarily designed for short-term, intraday trading strategies like scalping and high-frequency trading. However, that doesn't mean it can't be used for longer-term trades. It might provide useful information about short-term volatility and price levels, but its usefulness may diminish for longer-term strategies as other factors like overall market trends, company fundamentals, and broader economic indicators become more important.

Is there a way to compare the 2-Minute Range in $ to the Daily Dollar Range of a stock?

You can create a simple ratio formula to see how the 2 Minute Range contributes to the total day's range with the help of our Formula Editor.

The formula you could use is: [Range2]/[TRangeD]

This formula will give you the fraction of the total day's range that is accounted for by the 2 Minute Range. This comparison can give you a sense of how much short-term volatility is happening compared to the total day's volatility.

For example, let's say that the price of the stock varied by $1.50 throughout the day and the price of the stock varied by $0.15 in a specific 2-minute interval. The calculation would then be:

$0.15/$1.50 = 0.1 or 10%

This means that the 2 Minute Range represents 10% of the total day's range, indicating significant short-term volatility during that specific 2-minute interval.

A higher ratio (i.e., closer to 1 or 100%) suggests that a significant part of the day's price movement is happening within 2-minute intervals, which might indicate a higher level of short-term volatility. Conversely, a lower ratio (i.e., closer to 0) suggests that the 2-minute price movements contribute less to the overall day's range, potentially indicating lower short-term volatility.

This ratio could be used to inform your trading decisions based on your trading strategy and tolerance for volatility. For example, if you are a short-term trader who is looking for stocks with high volatility, you might look for stocks with a high 2-Minute Range to Daily Range ratio.

This is just one simple way to compare these two measures, and you may want to consider using additional technical indicators or analysis methods for a more comprehensive view of the market.

I am trying to build a scan that will detect a "triangle" consolidation pattern. My approach is to have a narrowing range over time, that is, the 2 min range is less than the 5 min range, which is less than 15 minute range, and so on. My problem is that the formula I am using does not seem to narrow my results at all.

The issue you are seeing is due to the fact that our Range filters are overlapping.

Because each snapshot includes all the prices from the previous snapshots, it's practically impossible for a snapshot taken earlier to have a larger range than one taken later. So, for example, if you saw a price jump in the first two minutes (Range2), that price jump is included in all subsequent ranges (Range5, Range15, etc.), making it impossible for Range2 to be bigger than any of the later ranges.

Instead of just looking only at the price range, you might want to look at the change in price range between each consecutive pair and check if this change is getting smaller, which could indicate a triangle pattern.

Here is a formula you could use in our Formula Editor:

(([Range5] - [Range2]) / [Range2]) > (([Range15] - [Range5]) / [Range5]) && (([Range15] - [Range5]) / [Range5]) > (([Range30] - [Range15]) / [Range15]) && (([Range30]-[Range15]) / [Range15]) > (([Range60] - [Range30]) / [Range30]) && (([Range60] - [Range30]) / [Range30]) > (([Range120] - [Range60]) / [Range60])

This code calculates the relative difference between each pair of consecutive ranges, and checks if this rate of change is decreasing faster and faster.

Is there a difference between the the various Range in Dollar Filters or do they all work exactly the same way?

Yes, there is a difference. The 2 Minute Range ($) Filter is precise to the second, whereas the 5 to 120 Minute Range ($) Filters are precise to the minute.

What is the difference between the Range 2 Minute ($) Filter and the Change 2 Minute ($) Filter?

The Range 2 Minute ($) Filter and the Change 2 Minute ($) Filter are both used to track short-term changes in a stock's price. However, they measure different aspects of price movement.

- Range 2 Minute $: This filter focuses on the total price movement within a 2-minute window, regardless of the direction. It calculates the difference between the highest and lowest prices within that period. It's not concerned with the direction of the price movement, only the extent of it. For example, if a stock goes from $10 to $11, then down to $9.80 within a 2-minute window, the range would be $1.20 (the difference between the highest price, $11, and the lowest price, $9.80). This filter is especially useful in capturing the volatility or fluctuations of a stock within a very short timeframe.

- Change 2 Minutes $: This filter, on the other hand, is concerned with the net change in the stock price over the last 2 minutes. It calculates the difference between the price at the start of the 2-minute period and the price at the end, i.e. the current price. The direction of the price movement is important for this filter. Using the same example, if a stock goes from $10 to $11, then down to $9.80 within a 2-minute window, the change would be -$0.20 (the difference between the initial price, $10, and the final price, $9.80). This filter would be useful for traders looking to identify stocks that have moved a certain dollar amount in the last 2 minutes, regardless of the volatility within that timeframe.

Both filters can be useful, but they serve different purposes. The Range 2 Minute $ filter is useful for understanding short-term volatility, while the Change 2 Minutes $ filter helps traders identify stocks that have moved a certain dollar amount over a short period.

Filter Info for 2 Minute Range [Range2]

- description = 2 Minute Range

- keywords = Fixed Time Frame

- units = $

- format = p

- toplistable = 1

- parent_code =

2 Minute Range [Range2P]

2 Minute Range [Range2P] 5 Minute Range [Range5]

5 Minute Range [Range5] 5 Minute Range [Range5P]

5 Minute Range [Range5P] 15 Minute Range [Range15]

15 Minute Range [Range15] 15 Minute Range [Range15P]

15 Minute Range [Range15P] 30 Minute Range [Range30]

30 Minute Range [Range30] 30 Minute Range [Range30P]

30 Minute Range [Range30P] 60 Minute Range [Range60]

60 Minute Range [Range60] 60 Minute Range [Range60P]

60 Minute Range [Range60P] 120 Minute Range [Range120]

120 Minute Range [Range120] 120 Minute Range [Range120P]

120 Minute Range [Range120P]