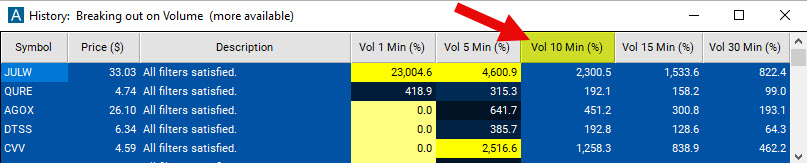

Volume 10 Minute

Table of Contents

- Understanding the Volume 10 Minute Percent Filter

- Volume 10 Minute Percent Filter Settings

- Using Volume 10 Minute Percent in Trading

- FAQs about Volume 10 Minute Percent

Understanding the Volume 10 Minute Percent Filter

The Volume 10 Minute Percent Filter shows how the last 10 minute's trading volume compares to the expected volume for a ten minute period based on the average trading volume over the last 10 days. The result is a percentage.

A percentage of 100% would indicate that the volume of shares traded aligns exactly with what would be expected given the average daily volume. Any percentage over 100% indicates that trading volume is higher than expected for the last 10-Minute period.

For instance, if you get a result of 400%, that means the stock has been trading at 4 times its average ten minute volume over the last 10 minutes. Conversely, if you get a result of 50%, that means the stock has only been trading at half of its average ten minute volume.

The Volume 10 Minute Percent Filter works before and after regular market hours. You should, however, adjust the thresholds for pre- and postmarket scanning, since stocks typically trade significantly less during these hours.

The formula for this filter is as follows:

((Volume 10 Minute in Shares/Average Daily Volume over the last 10 days) *39) *100

39 represents the number of ten minute periods in a 6.5-hour trading day.

100 turns the ratio into a percentage.

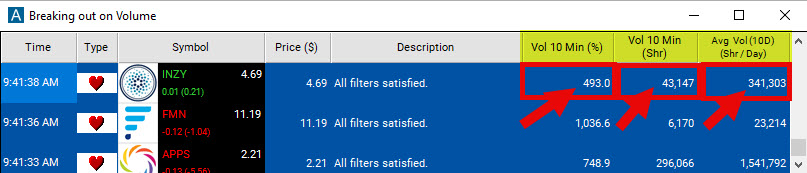

Take INZY as an example, the Average Daily Volume over the last ten days of this stock was 341,303 shares and the Volume 10 Minute in Shares was 43,147. Applying the above formula INZY's Volume 10 Minute in % would be calculated as follows:

((43,147/341,303)*39)*100 = 493%

This means that INZY's volume of shares traded in the last ten minutes represents 493% of the average ten minute volume.

Volume 10 Minute Percent Filter Settings

Activating the Volume 10 Minute % Filter is straightforward. You'll find its settings under the Window Specific Filters Tab in your Alert/Top List Window's Configuration Window.

You can set a minimum and/or maximum value, and stocks that don't fit within your parameters are automatically excluded from your scan results.

-

To find stocks that have been trading at least 3 times as much as normal in the last 10 minutes, add the Volume 10 Minute Percent Filter to your scan and enter 300 in the minimum field in the Windows Specific Filters Tab.

-

To find stocks that have been trading less than normal over the last 10 minutes, add the Volume 10 Minute Percent Filter to your scan and enter 90 in the maximum field in the Windows Specific Filters Tab.

This video is showcasing the settings of the 1 Min Volume % Filter, but the exact same steps apply to this filter.

Using Volume 10 Minute Percent in Trading

The Volume 10 Minute % Filter can be a particularly effective tool for active traders, as it allows them to monitor unusual volume activity within very short time-frames. Traders can use several strategies to capitalize on this metric. Remember that these strategies are inherently short-term due to the ten-minute time frame used by the filter. As with all trading strategies, the risk should be managed effectively, and individual positions should not represent a disproportionate amount of the trading capital.

Here's how you might use the Volume 10 Minute % Filter in trading:

- Breakout Strategy: Use the Volume 10 Minute Percent Filter to identify breakouts. A breakout occurs when a stock price moves above a resistance level or below a support level on significantly high volume. In this case, set your filter to a high percentage (e.g., over 300%) to locate stocks trading at a much higher than usual volume. This surge in volume can confirm the strength of the breakout.

- Volume Surge Mean Reversion: This strategy assumes that a sudden increase in volume might lead to a short-term overreaction, after which the price might revert to its mean. You can set the filter to identify stocks that have traded at an extremely high volume in the last 10 minutes (for instance, 400% or above), and then look for opportunities to trade against the resulting price move in anticipation of a reversion to the mean.

- Pre/Post-Market Trading: Use the Volume 10 Minute Percent Filter to identify stocks that are experiencing higher than average volumes in pre-market or post-market sessions. Although you should adjust the thresholds because volumes are generally lower outside regular trading hours, these anomalies could indicate a large reaction to news events or significant trader interest that could carry over into the regular session.

- Low Volume Avoidance: Conversely, you can use the filter to avoid stocks that are experiencing unusually low volume. Trading in low-volume environments can be risky due to larger spreads and more significant price impacts from trades. By setting a higher lower limit on your filter (e.g., 50% or more), you can ensure that you are only trading stocks with sufficient liquidity to enter and exit positions quickly.

- Fade Strategy: If a stock's volume is significantly lower than average (e.g., 30-50%), it could indicate a lack of interest or conviction in its current price movement. Traders can use this as an opportunity to initiate a fade strategy, which involves trading against the prevailing price trend, under the assumption that the price will move towards a direction that supports the volume.

Remember to combine this filter with other technical indicators for more robust and comprehensive trading strategies. For instance, volume can confirm signals from trend lines, moving averages, or momentum oscillators.

FAQs about Volume 10 Minute Percent

How can I see the actual number of shares a stock has traded in the last 10 minutes, or scan for stocks based on the volume they traded in the last ten minutes?

This data point is available for use in custom filters. To create a custom filter showing you the number of shares a stock has traded in the last ten minutes, enter the code v_up_10 in the Formula Editor.

Once created and added to your scan, this custom filter can be used just like our preset filters. You can display it as a data column in any scan, or filter stocks based on the minimum and/or maximum number of shares they have traded in the last ten minutes.

Does the Volume 10 Minute % Filter look at the open or close of the candle?

The calculation for the Volume 10 Minute % Filter isn't influenced by the specific components of ten minute bars, such as the opening or closing points. Rather, this filter operates on a continuous time basis, assessing the trading volume in relation to exactly ten minutes in the past, irrespective of the candlestick charting. This means it is continually evaluating volume changes over rolling ten minute intervals, providing real-time insights beyond the static start and end points of individual candlesticks.

There are various timeframes available for the Volume % Filter, which timeframe should I choose?

Choosing the appropriate timeframe for a trading strategy is largely dependent on the individual trader's style, goals, and risk tolerance. Here are a few factors that can influence this decision:

- Trading style: Day traders, who open and close positions within a single trading day, might prefer shorter timeframes, like 1-minute, 5-minute, or 10-minute volume filters, to help them identify quick trading opportunities. Swing traders, who typically hold positions for a few days to a few weeks, might use longer timeframes, such as the 30-minute or even daily volume filters.

- Volatility: If a trader is looking to profit from rapid price changes, they may opt for shorter timeframes to catch these movements. For instance, during earnings announcements or other significant news events, the 1-minute or 5-minute filters could be more useful to capture quick volume surges and the resulting price movements.

- Signal reliability: While shorter timeframes can give more trading signals, they also come with a higher likelihood of false signals. This is because shorter-term fluctuations can be more random and less indicative of the broader trend. Longer timeframes, like the 30-minute filter, might produce fewer signals but could be more reliable, as they smooth out the random noise in the market.

- Time commitment: Shorter timeframes typically require a higher time commitment from the trader and more active management of positions. Longer timeframes would require less time spent actively watching and managing trades.

- Strategy complement: If a volume filter is being used in conjunction with other indicators, the trader will want to ensure the timeframes are aligned. For example, if they're using a 15-minute candlestick chart to monitor price patterns, they might choose to use the 15-minute volume filter.

- Risk management: Shorter timeframes can sometimes mean tighter stop losses, which can potentially increase the risk of being stopped out of a position on a minor price movement. Longer timeframes might allow for wider stop losses and more room for price to move.

Some traders might even use a combination of different timeframes - for example, a longer timeframe to identify the overall trend and a shorter timeframe to pinpoint entry and exit points. It's also important to backtest and adjust any strategy based on the trader's personal experience and the market's response to the chosen timeframe.

Would it make sense to use various of these volume filters in conjunction?

Yes, using various volume filters in combination can provide more comprehensive insight into the volume dynamics of a stock and aid in refining a trading strategy. Here are a few examples:

- Multi-Timeframe Analysis: Traders could use a combination of volume filters to understand the volume flow on multiple timeframes. For example, using 1-minute, 5-minute, and 15-minute volume filters concurrently can provide a more granular picture of how the volume is behaving. Significant increases in volume at multiple timeframes can indicate stronger trading interest and possibly a more sustainable price move.

- Identifying Volume Exhaustion: Traders could use a longer-term volume filter (like a 30-minute filter) in combination with a short-term filter (like a 1-minute or 5-minute filter) to spot potential volume exhaustion points. For instance, if a stock sees a volume spike on the 1-minute filter but not on the 30-minute filter, it could suggest that the spike is more of a short-term anomaly and might soon fade, which could be a potential trading opportunity.

- Breakout Confirmation: Traders can use volume filters at multiple timeframes to confirm breakouts. A valid breakout should show a significant increase in volume at multiple timeframes. For example, if a breakout is accompanied by a volume surge on both the 5-minute and 15-minute filters, it may provide stronger confirmation of the breakout's validity compared to a volume surge on just one timeframe.

- Volume-Based Stop Adjustment: Traders can use the volume filter information to dynamically adjust their stop-loss levels. For example, if a trader enters a position based on a surge in the 5-minute volume filter, they might initially set a tight stop. But if the volume remains elevated in the following 10-minute or 15-minute periods, they might choose to loosen their stop to give the trade more room to work.

Remember, while the combination of different timeframe volume filters can provide additional insight, it's crucial to remember that no indicator or set of indicators is foolproof. It's essential to use them as part of a comprehensive trading strategy that also considers other factors like price action, other technical indicators, risk management, and trader's personal experience and judgment.

What could be causing extreme spikes as shown by the Volume 10 Minute Percent Filter?

Extreme spikes in the Volume 10 Minute Percent Filter often result from significant news events, earnings releases, or large trades by institutional investors. High volume can indicate strong investor interest and potential price volatility. However, it's important to look at the context: if the price is not moving significantly with high volume, it could indicate indecision in the market.

How can I incorporate the Volume 10 Minute Percent Filter into my existing trading strategy?

The Volume 10 Minute Percent Filter can be used as an additional layer of confirmation for your trading signals. For instance, if your strategy generates a buy signal, you may choose to only take the trade if the volume is above a certain threshold, suggesting strong buying interest.

How can I adjust the Volume 10 Minute Percent Filter for different market conditions?

You should remember to adjust the settings of your Volume 10 Minute Percent Filter based on different market conditions. For instance, during more volatile periods, you may wish to raise your minimum threshold to catch only the most extreme volume surges. Conversely, in quieter markets, lowering the threshold might provide more actionable signals.

How reliable is the Volume 10 Minute Percent Filter for detecting meaningful market activity?

Like any technical indicator, the Volume 10 Minute Percent Filter is not infallible and should not be used in isolation. It is most reliable when combined with other indicators and used as part of a comprehensive trading strategy. The key is to find combinations of filters and indicators that work best for your trading style and risk tolerance.

Always remember to factor in the broader market context, your overall trading strategy, and risk management principles when making trading decisions.

How can I use the Volume 10 Minute Percent Filter in short selling strategies?

For short selling strategies, you could use the Volume 10 Minute Percent Filter to identify potential overbought conditions that may precede a price drop. For instance, a very high filter value could indicate a rush of buyers, which might not be sustainable. If this surge is coupled with other indicators like an overbought RSI or a reversal candlestick pattern, it may suggest a good short selling opportunity.

How do the Volume 10 Minute % Filter and the Relative Volume Filter compare?

The Volume 10 Minute Percent Filter and the Relative Volume Filter are both useful tools for traders, and they serve slightly different purposes, so the choice between them depends on the specific needs of the trader.

Use the Volume 10 Minute Percent Filter when you want to monitor changes in trading volume on an intraday basis. It's particularly useful if you're interested in trading during premarket hours, since the Relative Volume Filter does not work in the early morning session.

On the other hand, use the Relative Volume Filter when you want a more contextual view of the trading volume, comparing the current volume to the average volume for the same time of day. This is particularly useful for identifying shifts in market sentiment that might not be immediately apparent from the raw trading volume alone.

How does the filter handle stocks with low liquidity or high volatility?

The filter calculates a percentage based on trading volume, so it will function regardless of the liquidity or volatility of a stock. However, for low-liquidity stocks, volume data may be more erratic, and high percentages may be less meaningful. For high-volatility stocks, large volume changes may occur frequently.

Are there any potential pitfalls or limitations when using the Volume 10 Minute Percent Filter?

As with any indicator, it's not foolproof. A sudden spike in volume doesn't necessarily mean a profitable trading opportunity will follow. It's essential to combine it with other indicators and techniques to confirm trading signals.

How does this filter perform in longer timeframes?

The Volume 10 Minute Percent Filter is specifically designed for a 10-Minute timeframe, capturing intraday volume spikes. It may not provide meaningful information when used in longer timeframes, like daily or weekly.

How sensitive is the Volume 10 Minute Percent Filter to sudden, large trades by a single entity (like institutional investors or hedge funds)?

The Volume 10 Minute Percent Filter can be quite sensitive to large trades by a single entity. If such a trade significantly increases the volume in a ten-minute period, it could trigger the filter. This sensitivity can be both a strength and a weakness. It's a strength in that it can alert you to major market moves, but a weakness in that it could lead to false signals if the large trade does not represent broader market sentiment.

How does this filter handle split or reverse-split stocks where the volume of shares traded could be impacted significantly?

The Volume 10 Minute Percent Filter by itself does not account for stock splits or reverse splits. If a stock splits or reverse splits, the volume will change significantly, and this could impact the filter.

Filter Info for Volume 10 Minute [Vol10]

- description = Volume 10 Minute

- keywords = Fixed Time Frame

- units = %

- format = 1

- toplistable = 1

- parent_code = Vol5