Trailing Stop, Volatility Up

Table of Contents

- Understanding the Trailing Stop Volatility Up Alert

- Default Settings

- Custom Settings

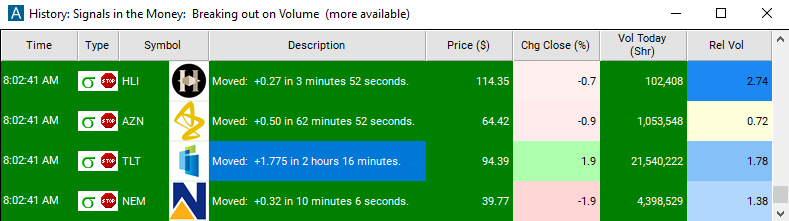

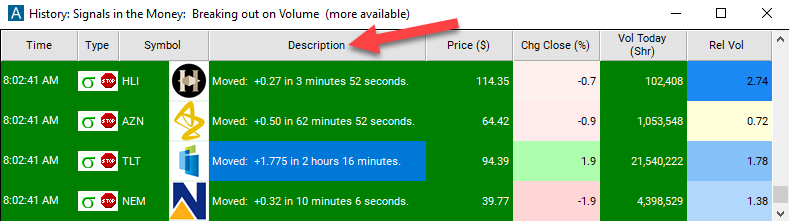

- Description Column

Understanding the Trailing Stop Volatility Up Alert

This alert is very similar to the Trailing Stop, % up, but this is triggered by volatility, not percent. This makes it easier to use just one filter value for a lot of stocks. This also prevents the same stocks from reporting a lot every day, while other stocks never report. Stocks which are move volatile will have to move further to set of an alert.

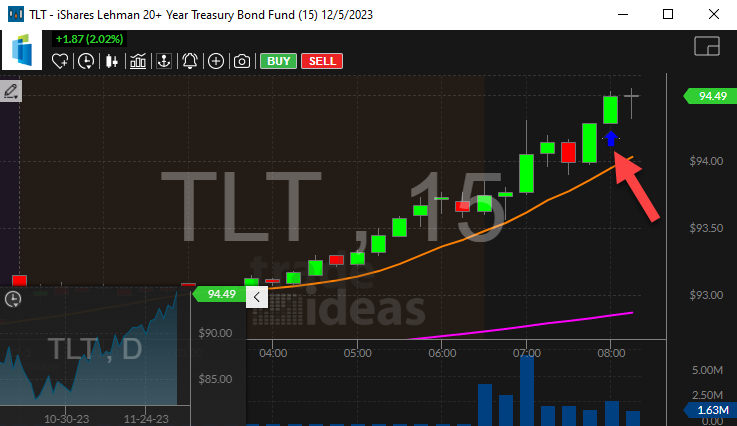

This alert uses the same volatility measurements that we use throughout the system. One "bar" is the amount that a stock typically moves between each bar of a 15 minute bar chart.

This alert will first report when a stock moves an entire bar off of its last high or low. Additional alerts will appear each time the stock continues in the same direction for another 1/2 bar.

Some traders prefer the % version of this alert because the math is easier; they can see exactly what the alert is doing. In most cases, we recommend that you use the volatility version of this alert. Let our servers do your homework for you; let us tell you how large a move has to be before it is considered interesting. That way you'll get the right value for every stock, and the values will be updated every night. Look up a stock in our stock screener if you want to know the exact value of a volatility bar for that stock.

Default Settings

By default, the Trailing Stop, Volatility Up alert appears when a stock moves an entire bar off of its last high or low. Additional alerts will appear each time the stock continues in the same direction for another 1/2 bar.

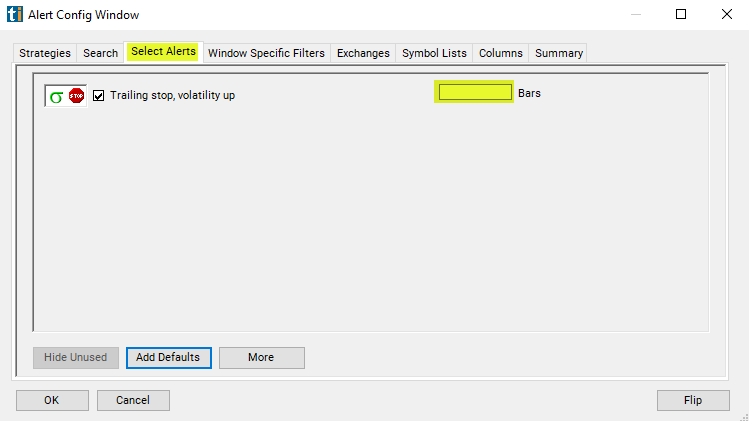

Custom Settings

For 'Trailing Stop, Volatility Up' alerts, you have the option to use an alert specific filter. This filter is located immediately to the right of the corresponding alert and is always optional. You can decide to leave it blank if you want to receive more alerts, or you can fill it in to restrict the number of alerts you receive. This filter allows you to specify the quality of the alert. When you set a higher number for this filter, you are telling the alerts server to display only alerts that meet a higher quality standard, resulting in fewer alerts being shown.

When setting an alert for 'Trailing Stop, Volatility Up', the user can filter the alert by increasing the period to see fewer alerts. For example, you might only want to see these alerts each time the stock moves half of the standard volatility number, or each time it moves 2 times the standard volatility number. Each of these will show you alerts less frequently, but you will still see alerts spread throughout the day.

The basic idea is that the size of the move has to be a multiple of the value in the filter. Set the filter to 2 and you will only see when the stock price moves 2 times the standard volatility number, 4 times the volatility number, 6 times, etc.

This filter is designed primarily for people using these alerts to make a ticker. This shows you how quickly stocks are moving, and in what direction. It's good for getting an overview of a lot of stocks.

We do not recommend using this filter if you are trying to debug your trailing stops. These alerts are much more precise if you leave this filter blank.

Description Column

The alert description will provide real-time information on the stock's volatility increase within a specific time frame.

Alert Info for Trailing Stop, Volatility Up [TSSU]

- description = Trailing stop, volatility up

- direction = +

- keywords =

- flip_code =

Trailing stop, volatility down [TSSD]

Trailing stop, volatility down [TSSD] - parent_code =