Crossed Below Close (confirmed)

Table of Contents

Understanding the Crossed Below Close Confirmed Alert

This alert presents information similar to its unconfirmed counterpart. Each time the price of the last print crosses below the closing price, the preceding unconfirmed alert appears. The advantage of this is that the messages are instant, and the last message shows the current direction of the market. The disadvantage is that it is noisy. If the price stays near the close, many alerts will appear.

The alert listed here requires statistical confirmation before it appears. This filters out noise, but requires a slight delay. This analysis involves price, time, and volume. If the price continues to move around the close, this alert may never appear. Once the price chooses a direction the exact amount of time required for the alert to appear depends on volume.

The statistical analysis does not require that every print cross below the close before the alert is displayed. The analysis filters out insignificant prints that go against the general trend. It is even possible, although unlikely, that the last print disagrees with the analysis as a whole.

Default Settings

By default, the crossed below close (confirmed) alert will appear when the price of the last print crosses below the close at a sufficient price, time, and volume.

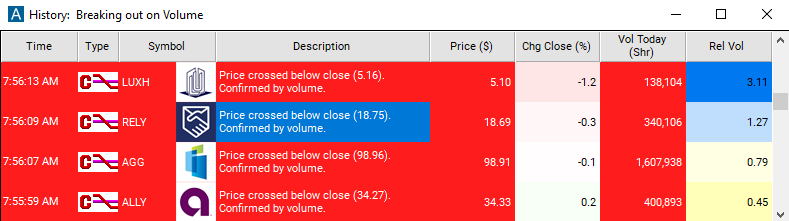

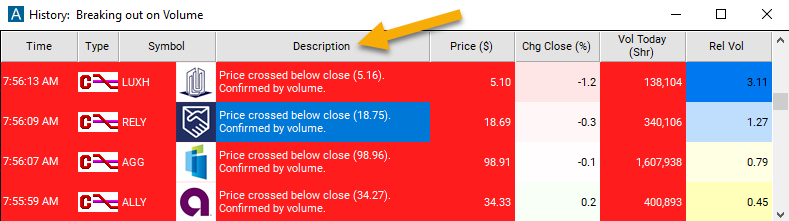

Description Column

The description column of this alert will report the price at which the stock crossed below the close and that is was confirmed by volume.

Alert Info for Crossed Below Close (confirmed) [CBCC]

- description = Crossed below close (confirmed)

- direction = -

- keywords = Volume Confirmed

- flip_code =

Crossed above close (confirmed) [CACC]

Crossed above close (confirmed) [CACC] - parent_code = CAOC