Positive Market Divergence

Table of Contents

- Understanding the Positive Market Divergence Alert

- Default Settings

- Custom Settings

- Description Column

- Quality Column

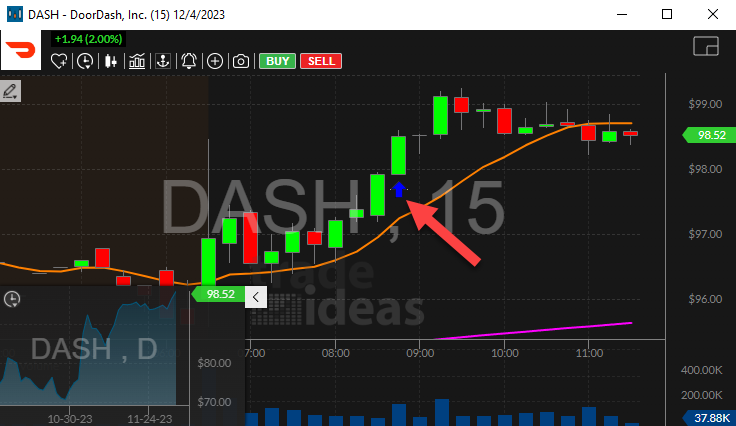

Understanding the Positive Market Divergence Alert

This alert is similar to the Sector Breakout (from close) alert. This is optimized to work well in the low volume times, such as before and after official market hours.

The Sector Breakout (from open/close) alerts look at a number of possible sectors and indexes and choose one to match each stock. They make this choice based on how well the prices match during a typical trading day. The market divergence alerts try to compare each stock to QQQ. This is a popular point of comparison because it is a broad-based index and it is so liquid, even before and after normal trading hours. The market divergence alerts also use a slightly different algorithm than the previous alerts to compare the stocks. This algorithm pays more attention to the previous close and minimizes the effects of the opening prices. As with the previous alert types, some stocks do not usually move with QQQ, so we do not report alerts for those stocks.

If you do a lot of trading before the open or in other low volume times, this alert is ideal. But it is also useful to traders who only trade at the open and other high-volume times. For instance, take the strategy of open order enveloping. In this strategy traders assume that the specialist is manipulating the opening print, and they try to take advantage of this. They start shortly before the open by using yesterday's close and the current price of the futures to predict a reasonable opening value for a stock. They assume that the actual opening price will often differ from the expected value but will usually move toward that value after the open. After placing your initial orders, use the market divergence alerts to watch your stocks. You will see alerts if the stocks move away from the expected value, moving against you. You will see no alerts as long as the stock moves toward the expected value.

Default Settings

By default, the 'Positive Market Divergence' alert will appear when the stocks move away (+) from the expected value relative to QQQ.

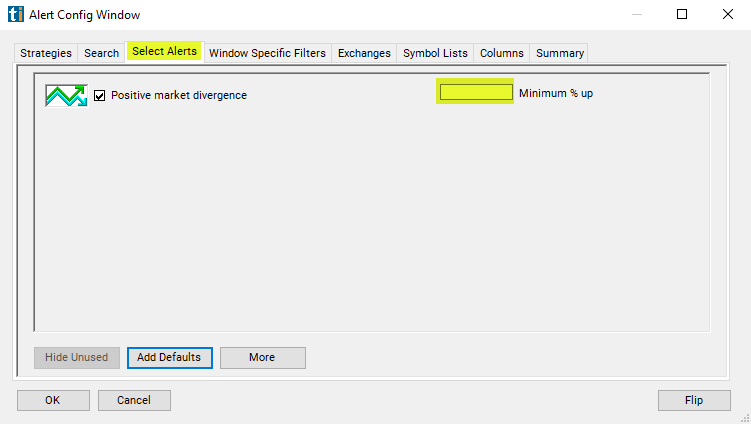

Custom Settings

For 'Positive Market Divergence' alerts, you have the option to use an alert specific filter. This filter is located immediately to the right of the corresponding alert and is always optional. You can decide to leave it blank if you want to receive more alerts, or you can fill it in to restrict the number of alerts you receive. This filter allows you to specify the quality of the alert. When you set a higher number for this filter, you are telling the alerts server to display only alerts that meet a higher quality standard, resulting in fewer alerts being shown.

When setting an alert for 'Positive Market Divergence', the user can filter the alert by minimum percentage changed. This value is always displayed in the alert description. The server reports each integer value, and no others. It never does any rounding. The minimum value is different for different alerts.

Typically, each symbol will only report one of these alerts per day at each % level. However, after recovering from a bad print, or other major changes in the price, the server may repeat some alerts.

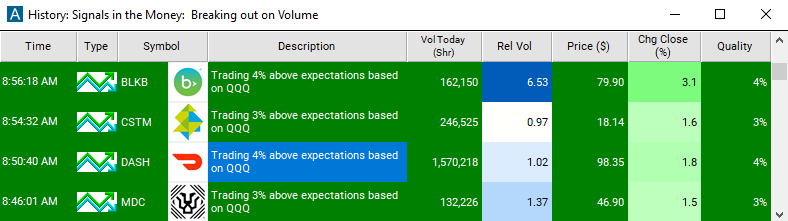

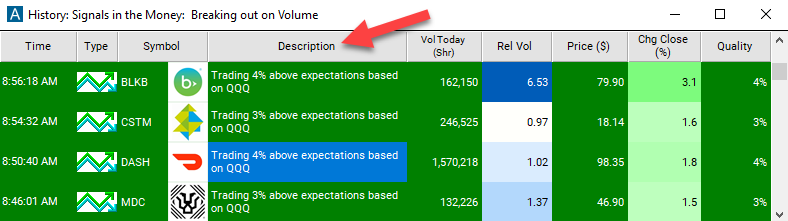

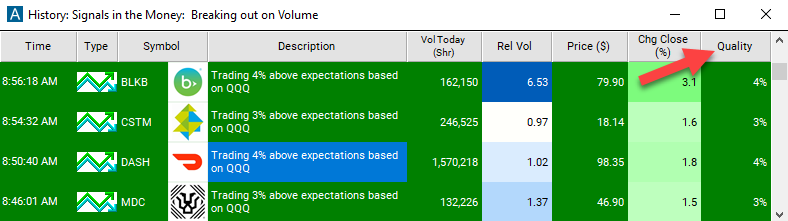

Description Column

The alert's description will provide a more comprehensive breakdown of the alert.

Quality Column

The quality value on a scan using the 'Positive Market Divergence' alert will show the % above expectations that a stock is trading.

Alert Info for Positive Market Divergence [FDP]

- description = Positive market divergence

- direction = +

- keywords =

- flip_code =

Negative market divergence [FDN]

Negative market divergence [FDN] - parent_code =