Shares Outstanding

Table of Contents

- Understanding the Shares Outstanding Filter

- Shares Outstanding Filter Settings

- Using the Shares Outstanding Filter

- FAQs

Understanding the Shares Outstanding Filter

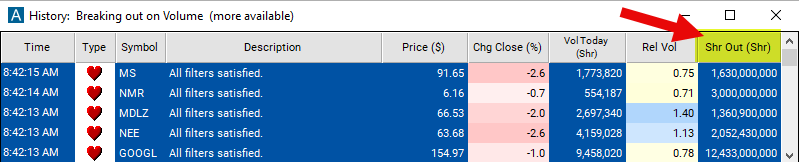

The shares outstanding filter in stock trading refers to a criterion used to screen stocks based on the total number of shares issued by a company that are held by investors. Shares outstanding represent all shares of a company's stock that have been authorized, issued, and purchased by investors, including those held by institutional investors, insiders, and the public. This filter allows traders to focus on stocks with specific characteristics related to their share structure. Typically, traders may use shares outstanding as a measure of a company's size, ownership structure, and liquidity. Stocks with a higher number of shares outstanding may indicate larger, more established companies, while those with fewer shares outstanding may suggest smaller, emerging companies. By filtering stocks based on shares outstanding, traders can tailor their investment strategies to align with their risk preferences, investment objectives, and market conditions.

Shares Outstanding Filter Settings

Configuring the "Shares Outstanding" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

- Adjust the minimum value to 1,000,000,000 to see only stocks with at least 1 billion outstanding shares.

Using the Shares Outstanding Filter

The "Shares Outstanding" filter can be used in various trading strategies, including:

Contrarian Approach: Some traders look for companies with a high number of outstanding shares that may be undervalued or overlooked by the market. They believe that these companies have the potential for significant price movement if market sentiment changes or if there is positive news or developments.

Liquidity Considerations: Traders may use the outstanding shares filter to ensure they are trading stocks with sufficient liquidity. Companies with a high number of outstanding shares tend to have higher liquidity, making it easier to enter and exit positions without significant price impact.

Volatility Analysis: Traders may analyze the relationship between outstanding shares and stock price volatility. Companies with a high number of outstanding shares may exhibit less price volatility compared to those with fewer outstanding shares. Traders may adjust their risk management and position sizing strategies accordingly.

FAQs

What are outstanding shares?

- Outstanding shares refer to the total number of shares of a company's stock that are currently held by investors, including institutional investors, insiders, and the public. These shares are available for trading on the stock market.

How does the number of outstanding shares affect stock price?

- The number of outstanding shares can impact a stock's price and its volatility. Generally, a higher number of outstanding shares may lead to lower stock price volatility and reduced potential for large price swings compared to companies with fewer outstanding shares. However, other factors such as market sentiment, earnings reports, and industry trends also influence stock prices.

What is considered a high number of outstanding shares?

- The definition of a "high" number of outstanding shares can vary depending on the size and industry of the company. Generally, larger companies tend to have a higher number of outstanding shares compared to smaller companies. Traders may consider relative comparisons within the same industry or sector when evaluating the significance of outstanding share numbers.

How can I use the outstanding shares filter in my trading strategy?

- Traders can use the outstanding shares filter to screen for stocks that meet specific liquidity or volatility criteria. For example, traders may prefer stocks with a high number of outstanding shares for their liquidity, making it easier to enter and exit positions. Additionally, outstanding shares data can provide insights into a company's market capitalization and its relative size within its industry.

Filter Info for Shares Outstanding [ShOut]

- description = Shares Outstanding

- keywords = Fundamentals Changes Daily

- units = Shares

- format = 0

- toplistable = 1

- parent_code =