Change Previous Day

Table of Contents

- Understanding the Change Previous Day Dollar Filter

- Change Previous Day Dollar Filter Settings

- Using the Change Previous Day Dollar Filter

- FAQs

Understanding the Change Previous Day Dollar Filter

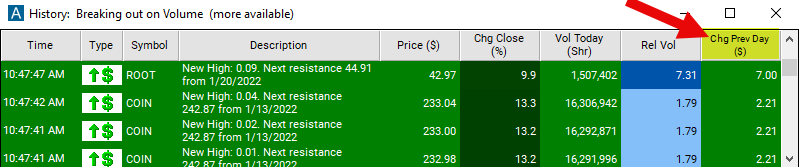

The "change previous day ($)" filter refers to the difference between the close from the previous trading day to the close from the day before that, measured in dollars. In short, these let you pick stocks which were up or down by a certain amount yesterday. This filter is important for traders who want to analyze price movements over a short-term horizon. It provides insights into how much the price has changed over the span of two trading days, helping traders identify trends or reversals in the stock's price movement.

Change Previous Day Dollar Filter Settings

The settings of each Trade Ideas filter are defined in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window.

Here is how to setup the filter in your configuration window:

- Set the min value to 2 to see stocks which were up at least $2 from the previous days close.

Using the Change Previous Day Dollar Filter

Several trading strategies can be employed with the Change Previous Day Dollar filter. Here are a few examples:

Trend Continuation Trading: In this strategy, traders aim to capitalize on the continuation of an existing trend over a short-term horizon. If there is a significant positive change from the previous day's close to the day before that, traders may interpret it as a continuation of an upward trend. They might consider entering long positions, expecting the trend to persist. Conversely, if there is a significant negative change, traders may consider short positions, anticipating a continuation of a downward trend.

Reversal Trading: Reversal traders aim to identify potential reversal points in the price movement. A significant change from the previous day's close to the day before that may indicate a potential reversal in the price trend. For example, if there was a strong upward trend, but the current day's price is significantly lower than the previous day's close, traders may interpret it as a signal for a potential trend reversal. They might then look for additional confirmation signals before entering a trade in the opposite direction.

Volatility Trading: Volatility traders aim to profit from fluctuations in the price of a stock. Traders may use the change from the previous day's close to the day before that as a gauge of short-term volatility. A significant change indicates heightened volatility, which can present trading opportunities. Traders may enter positions to capitalize on short-term price movements, such as scalping or day trading, taking advantage of the increased volatility.

FAQs

Why is the "change previous day ($)" filter important in trading?

- This filter is crucial for traders as it provides insights into short-term price movements over a two-day period. Understanding how much the price has changed can help traders identify trends, reversals, or potential trading opportunities.

How is the "change previous day ($)" calculated?

- The calculation involves subtracting the closing price of the stock from the previous trading day from the closing price of the day before that to determine the dollar amount by which the price has changed over the two-day period.

What does a positive/negative "change previous day ($)" indicate?

- A positive change indicates that the current price of the stock is higher than the previous day's close, while a negative change indicates that the current price is lower. These changes reflect the direction and magnitude of the price movement over the two-day period.

Filter Info for Change Previous Day [FCDP]

- description = Change Previous Day

- keywords = Changes Daily

- units = $

- format = p

- toplistable = 1

- parent_code =

Change Previous Day [FCPP]

Change Previous Day [FCPP]