10 Minute Bearish Engulfing

Table of Contents

- Understanding the 10 Minute Bearish Engulfing Alert

- Default Settings

- Custom Settings

- Description Column

- Quality Column

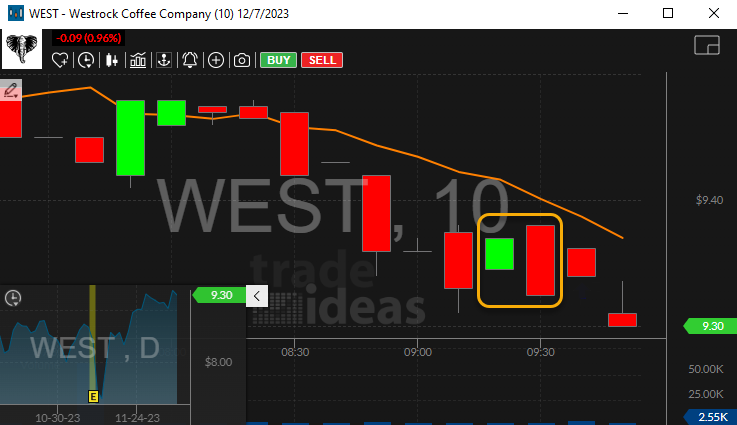

Understanding the 10 Minute Bearish Engulfing Alert

This alert signals the appearance of a bearish engulfing pattern on a traditional 10-minute candlestick chart. Components of a bearish engulfing pattern include:

-

The first candlestick is typically a green or bullish candlestick, indicating an upward price movement

-

The second candlestick is a red or bearish candlestick, indicating a downward price movement

-

The bearish candlestick "engulfs" the bullish one, meaning it opens below and closes above the previous candlestick

This pattern often signifies a shift in market sentiment from bullish to bearish, as sellers have taken control and pushed the price lower.

Default Settings

By default, the 10 minute bearish engulfing alert appears when there is a bearish engulfing pattern on a 10 minute candlestick chart.

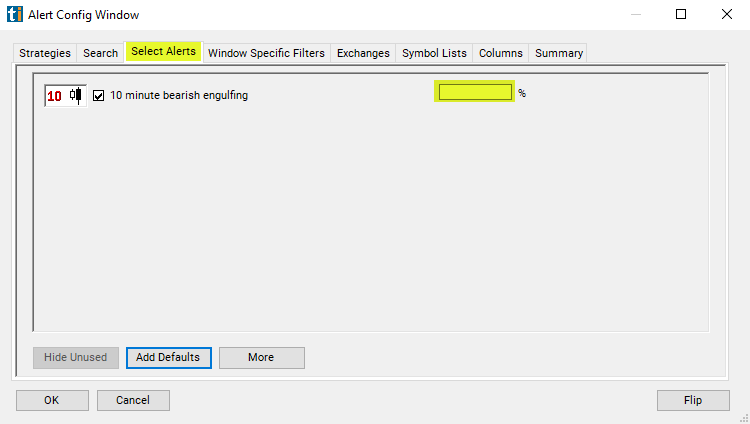

Custom Settings

For '10 Minute Bearish Engulfing' alerts, you have the option to use an alert specific filter. This filter is located immediately to the right of the corresponding alert and is always optional. You can decide to leave it blank if you want to receive more alerts, or you can fill it in to restrict the number of alerts you receive. This filter allows you to specify the quality of the alert. When you set a higher number for this filter, you are telling the alerts server to display only alerts that meet a higher quality standard, resulting in fewer alerts being shown.

When setting an alert for '10 Minute Bearish Engulfing', the user can filter these alerts by a grade of how on how closely the stock chart matches the ideal shape of the stock pattern. 0 would mean there was no match. 100 would mean it's an ideal match.

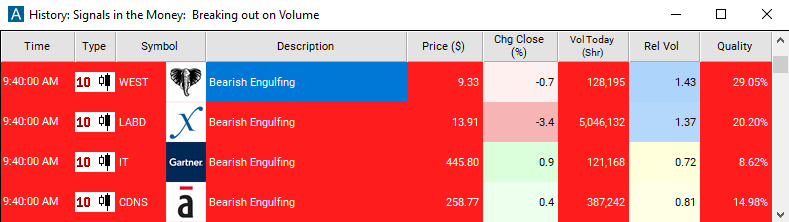

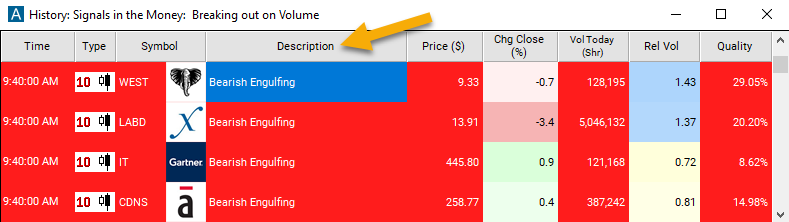

Description Column

The description of the alert will give a more comprehensive breakdown of the alert.

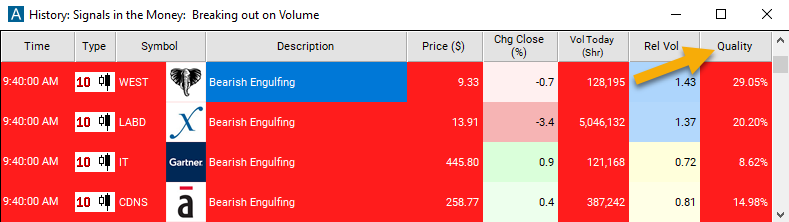

Quality Column

The quality value on a scan using the "10 Minute Bearish Engulfing" represents the grade based on how closely the stock chart matches the ideal shape of the stock pattern. 0% would mean that there was no match at all. Of course, if a stock pattern is this poor a match, then we are unlikely to report an alert. 100% would be an ideal match. Again, this would be an ideal and extreme case. Few if any alerts come close to 100%.

Alert Info for 10 Minute Bearish Engulfing [NGD10]

- description = 10 minute bearish engulfing

- direction = -

- keywords = Candle Pattern End Of Candle Fixed Time Frame

- flip_code =

10 minute bullish engulfing [NGU10]

10 minute bullish engulfing [NGU10] - parent_code = NGD5